Industry Clouds: The Next Big SaaS Opportunity

Why is Industry Software a Big Deal ?

From Telecom, Banking, and Insurance to Discrete Manufacturing, Utilities and Oil & Gas, every industry has evolved its own software stack over time. Each of this industry software ecosystems is filled with hundreds of vendors, driving tens of billions of dollars in total revenue.

In contrast to horizontal application software focused on productivity and enablement, industry software typically covers mission-critical, transactional processes related to how customers engage with the very core of the product or service offered by the firm. They are the systems of record holding all product, asset, transaction and customer data. They are also the systems of engagement that enable mission critical transactions between the company, its sales ecosystem, and its customers.

Take telecom as an example: It spent more than $25 B on application software in 2013 and is expected to top $34 B in 2018. This spend is larger than the size of the entire CRM software industry.

In verticals like banking, insurance, telecom, utilities and retail, industry-specific application software spend exceeds horizontal application software by more than 10:1.

Gartner estimates that industry software companies generated more than $114 B in revenue for 2014, representing almost 30% of all software spend.

Who Are These Companies That Make Industry Software?

Think Amdocs, Ericsson, Fiserv, FIS, McKesson, Infor and the like. While some of these names may not be well-known to the general public, they are all massive firms with > $10 B in market cap. McKesson is a Fortune 15 company and Infor is the largest private software company in the world.

So, what are the strengths of these incumbents? How did they become so big?

1. They are purpose-built for their focus industry. They have deep domain expertise and are very familiar with the industry dynamics.

2. They know what it means to be mission-critical. They live it every day.

3. They do whatever is required to make it work. They take accountability for business outcomes, albeit at a steep price.

4. They supply software + services over multi-year terms. They blend product+ services + support+BPO seamlessly.

5. Some of them are industry conglomerates who sell software in addition to industry equipment. They bundle software with other offerings, act as a one-stop shop for customers to buy, and serve as a key distribution channel and access point to the industry for multiple vendors.

But… the incumbents also have several challenges and suffer from structural drawbacks.

1. They are expensive and tend to optimize the business model for the vendor. Customer’s cash outflows are typically not well aligned with the value realized.

2. The implementations are heavily bastardized — meaning significant customization — and take many years to deploy.

3. Upgrading to newer versions means long and costly projects with massive time and cost over-runs.

4. They are mostly on-premise, adding significant IT tax in hardware, software infrastructure, networking and ongoing maintenance.

5. Once entrenched, these vendors tend to hold customers hostage and charge a hefty ransom for modifications. In fact, the more you invest, the deeper the hole you dig for yourself.

6. They are not built for the digital age: NOT (Cloud Apps, Cloud Platform, Natively Mobile, APIs, Metadata etc.).

As we witness the inexorable transition of CRM, HR, Financials and several other categories to the cloud, will industry software follow suit at scale?

While we already have a handful of multi-billion dollar industry cloud companies, it may just be the beginning. As cloud disruptors in large verticals better address current pain points and deliver better economics, we are likely to witness the creation of many large vertical SaaS companies over the next few years.

The incumbents do have great customer access and strong leverage. However, the scales are tipped against them as customers contrast the economics, convenience, and ease of use of the cloud with their current systems.

How Can Industry Cloud Companies Beat the Incumbents?

Here are top 6 considerations for new industry SaaS plays to break through and succeed.

1. Industry Business Processes vs. Thin Veneers

Industry flavors of Cloud CRM software that represent simple modifications to UI / objects do not represent industry software. There is no paucity of integrators and vendors who have built thin industry veneers for platforms like Force. They offer limited value.

Real industry software products address mission critical value chains with deep capabilities specific to that industry.

New vendors should start with specific niches (or) scenarios where incumbents have a deep vulnerability. These could be related to industry-specific big data/machine learning plays, or specialized use cases that are better addressed with new technologies.

Examples: RetailNext in Retail, OPower in Utilities, Synchronoss andCycle 30 in Telecom, CodeObjects in Insurance, Euclid Analytics in Retail, Vlocity in Insurance and Telecom, BloomReach and Rich Relevance in Retail.

2. Focus on Customer Engagement and Digital Transformation in the Front-Office vs. Back-Office

Legacy industry software is back-office centric. But the larger opportunity for transformation and differentiation is in the front-office. New digital technologies are helping companies transform business and operating models, and disruptors can help companies re-imagine the core of what they sell, what they bundle, how they price, how they support, and how best to manage and optimize the customer relationship over the entire lifecycle.

It is important to note that customers pay tens to hundreds of millions of dollars per year for industry solutions that are transactional and mission-critical. For example, AT&T spends >$1B per year on one vendor (Amdocs) who is responsible for order capture and billing, and who processes a major chunk of the ~ $140B of AT&T’s annual revenue per year.

Industry clouds can also be non-transactional (e.g. citizen management in public sector, or trouble ticketing in telecom), but still need to work seamlessly with existing systems around products, accounts, assets and orders.

3. Align Value Captured with Value Created.

Disrupt incumbent pricing by linking cost of software directly to value delivered — cost per order, cost per transaction, cost per bill, cost per claim, cost per interaction etc.

Experiment with multi-layered economic models where varied dimensions of value ( # of users, the scope of functionality, usage, # of channels, API volume etc.) are creatively arranged to align customer spend with adoption and success.

Support private cloud and hybrid deployments with hosted and managed options. Several customer situations and country regulations demand it.

4. Provide a Platform, Community, and Ecosystem, not just Apps.

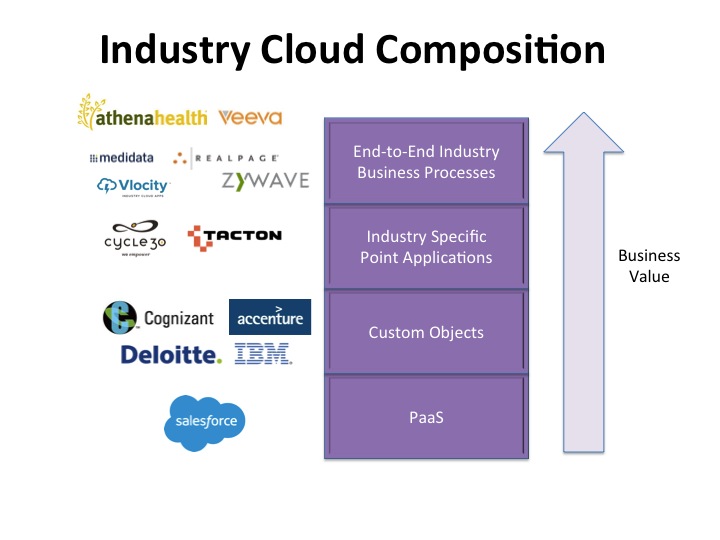

Successful vendors need to provide a robust cloud-based development platform (PaaS) to customize the software. Let there be no doubt that large enterprises are going to want extremely customized and tailored processes. The cost, productivity, and upgradeability of a cloud-based development platform is a sharp differentiator and contrast.

The vertical SaaS platform must dovetail with the core PaaS without losing its own identity. Vendors should offer a library of integrations to the most popular solutions in the industry and provide core APIs for others to integrate to.

Ideally, the vertical SaaS platform should enable the long-tail of industry solution innovation. This will build a strong moat and a long-term competitive advantage.

5. Optimize for Customer Success and Not Growth until Product-Market Fit.

The vendor’s ability to build a product business in the long-term is ironically better served by its openness to investing in the necessary professional services resources in the short term.

Lack of customer success is the biggest risk that can dampen growth. Vendors who deal with it aggressively through integrated customer development teams and tight feedback loops are in a much better position to get to product-market fit and scale the business.

Vendors need to step on the gas on building an SI ecosystem only after product market fit. It is crucial to get this timing right. Too early, you may end up with unhappy customers. Too late, a high percentage of low-margin services revenue will drag the business down.

Veeva Systems is a classic example of a company that has done this right. More analysis and links here.

Companies within an industry are tightly connected and word-of-mouth is a huge factor. Successful vertical SaaS companies can achieve far lower costs of acquisition than many of their horizontal equivalents.

6. Connect Buyers and Sellers in Unique Ways

Considerations 1–5 are really about being cheaper, better and smarter than incumbents by delivering on the cloud with a modern tech stack, shifting the focus to the customer experience, and providing a subscription based business model.

But, new industry SaaS solutions need not follow the templates of the past. They can also shift the game to new territory where incumbents are not present.

They can re-imagine the ways buyers find sellers, sellers find buyers, and how communication and engagement occur for specific use cases. A few examples below of industry SaaS marketplaces.

42 floors helps corporate real estate owners and renters find each other

Doximity helps physicians communicate with each other around a patient’s case

Opentable helps restaurants accept new reservations

Upcounsel helps legal firms find new leads at lower cost.

Edmodo and Remind 101 help educational institutions and teachers communicate with students and parents

Smartzip helps real estate agents find the best prospects

As a disruptor, you need to understand the game you are playing, how is it different vs. traditional and new competition, and how to keep score.

Of course, every incumbent is also trying to jump on to the cloud bandwagon, but history shows us that this is an incredibly hard act to pull off. Not only is it impossible to retool legacy technology from the ground up for the cloud, but also difficult to cannibalize the existing business model.

So, watch out for the emergence of new industry cloud companies over the next few years. They are likely to redistribute billions of dollars in customer spend from old industry software companies to new SaaS players, create new market caps worth tens of billions of dollars in the aggregate, and lead to several attractive investment and M&A opportunities in both private and public markets.